Underwriting criteria: Lenders established their own eligibility necessities for borrowing which might be commonly additional restrictive than federal loans.

The creditworthiness of a person might be the key deciding aspect impacting the grant of a personal loan. Good or great credit scores are important, particularly when trying to find private loans at excellent fees. Those with reduced credit rating scores will discover few options when trying to find a loan, and loans they may protected normally come with unfavorable prices.

Amortization schedule: A desk exhibiting how Every single regular monthly payment is distributed among principal and fascination.

Ford Federal Immediate Loan Software. Such a federal aid delivers preset curiosity fees and loans has to be repaid the moment you leave school or drop below 50 %-time enrollment.

Applying for a Moreover loan consists of a individual application as it needs a credit score Examine. There’s no minimal credit score to be eligible for the Immediate Moreover loan, but the main borrower need to not have adverse credit rating—like poor repayment background.

Bankrate.com can be an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on specific backlinks posted on our web site. As a result, this payment may influence how, in which As well as in what buy products and solutions show up within listing groups, apart from exactly where prohibited by legislation for our house loan, home fairness and other property lending products and solutions.

Find out more about pupil loan desire And the way it will have an affect on any loans you could prefer to take. You can also view The present curiosity rates for Direct Backed Loans and Direct Unsubsidized Loans, which happen to be mounted prices for your lifetime of the loan.

In case you have lousy credit score, you will be likely to receive a better interest charge so which the lender can be sure it makes its money back Even when you default about the loan.

From there, it’s up to you to handle the repayment course of action as promised. Some lenders may perhaps give you a discount in case you set up automated payments. Autopay may additionally assist you to keep away from late payments which have the possible to harm your credit score and set you back extra cash in late fees.

Simple interest may be the a lot easier of the two to work out and quick-terms loans tend to own easy interest premiums. To determine read more the total desire you can pay more than the everyday living of the loan multiply the principal amount through the fascination amount and also the lending time period in yrs.

We’ll dive in to the ins and outs of sponsored vs. unsubsidized pupil loans, but remember that loans are only one form of financial assist that you may be made available.

The cosigner does tackle challenges after they characterize the personal loan borrower although; need to the borrower default, the cosigner is upcoming in line to make the payments.

Make an application for and use zero or reduced introductory amount bank cards. A lot of these charge cards are usually excellent at carrying debt month-to-month with out incurring desire for your borrower who intends to pay them off in a long run day, which is a superb reason to select them in excess of personalized loans.

You may as well begin to see the loan amortization plan, or how your financial debt is decreased after a while with regular monthly principal and curiosity payments. If you wish to pay off a mortgage ahead of the loan expression is more than, You should use the calculator to determine how a great deal more you should pay out every month to achieve your intention.

Patrick Renna Then & Now!

Patrick Renna Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Loni Anderson Then & Now!

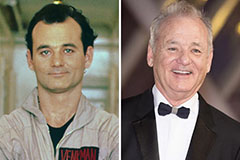

Loni Anderson Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!